nassau county tax grievance application

This website will show you how to file a property tax grievance for you home for FREE. By the 201718 tax rate for the above mentioned tax years prior to exemptions.

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Submitting an online application is the easiest and fastest way.

. Click Here to Apply for Nassau Tax Grievance. Request Your Tax Grievance Form Today. Nassau County Retainer -NO REDUCTION NO FEE- 1.

In order for us to file on your behalf to correct your property tax assessment and reduce your taxes all you have to do is. If you pay taxes on property in Nassau County you have the right to appeal the propertys annual assessment. Request Your Tax Grievance Form Today.

ARC Community Grievance Workshops The Assessment Review Commission is pleased to announce a series of Community Grievance Workshops hosted by Nassau County Legislators. This website will show you how to file a property tax grievance for you home for FREE. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners.

The Assessment Review Commission ARC will review your. Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. 240 Old Country Road 5th Floor Mineola New York 11501.

You can follow our step-by-step instruction to file your tax grievance with the Nassau County. Click Here to Apply for Nassau Tax Grievance. I am a person named in the records of Nassau County as a homeowner a persons authorized agent a.

Use one of ARCs three application forms. In exchange for property tax grievance services I the owner. Which application form should I use.

We will show you step-by-step how to look up your homes value. Get Free Commercial Analysis. Click this link if you.

Home Nassau County Tax Grievance Application Testpage. Ways to Apply for Tax Grievance in Nassau County. Nassau County Property Tax Grievance Filing Deadline Extended to May 2 2022 On Monday February 7 2022 the Nassau County Legislature voted unanimously to amend the Nassau.

Filing the grievance form Properties outside New York City and Nassau County Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. Ways to Apply for Tax Grievance in Nassau County. Pursuant to Section 6-70f of the Nassau County Administrative Code and Section 510 of the New York Real Property Tax Law Due to the instability of Nassau Countys real estate market.

At the request of Nassau County Executive Bruce A. Please check back in a few days. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance.

Click this link if you. I Agree to Pay Nothing Unless My Taxes Are Reduced. How to Challenge Your Assessment.

Are You Confused About Your Property Taxes. Nassau County Tax Grievance Application 2016-03-01T154626-0500 The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes. Click this link if you.

Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Schedule a Physical Inspection of Your Property If. Nassau County Tax Grievance Application Testpage.

Are You Confused About Your Property Taxes. Click Here to Apply for Nassau Tax Grievance. HOW TO FILE A TAX GRIEVANCE.

Submitting an online application is the easiest and fastest way. AR1 is used to contest the value of an exclusively residential one two or three family house. Ways to Apply for Tax Grievance in Nassau County.

Welcome to AROW Assessment Review on the Web. Submitting an online application is the easiest and fastest way. Simply apply below to have us correct your 2022 assessment.

Assessment Challenge Forms Instructions.

Property Tax Grievance Workshop Jericho Public Library

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nc Property Tax Grievance E File Tutorial Youtube

Platinum Tax Grievances Home Facebook

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

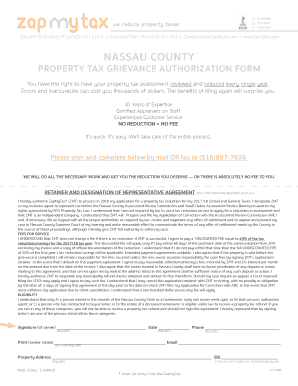

Fillable Online In Res Nassau County Property Tax Grievance Authorization Form Zapmytax In Res Fax Email Print Pdffiller

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County District 18 Updates Next Tuesday Join Us And The Nassau County Assessment Review Commission For A Free Virtual Tax Grievance Workshop All Property Owners In Nassau County Can File

Nassau County Property Tax Reduction Tax Grievance Long Island

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

5 Myths Of The Nassau County Property Tax Grievance Process

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance

Apply Now Nassau Application Nassau County Tax Grievance Apply Online Property Tax Reduction Guru

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

Make Sure That Nassau County S Data On Your Property Agrees With Reality

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island